Waymo vs Uber

Waymo has a great product but how will they scale, reduce costs and maintain high utilization?

How is Uber not totally screwed by Waymo?

I’ve seen this question in one form or another more times than I can count lately. And it’s not just folks on Twitter; almost everyone who’s taken a Waymo has been blown away by the product. The ride is smooth, the ‘driver’ is safe, and it feels like you’re in the future. There’s a reason why I have a section in each week’s newsletter dedicated to peoples’ first AV rides - Waymo is a magical experience. So it makes sense to ask the question, why would I ever ride in an Uber again?

Well, even though Waymo has delivered and then some with their experience and product, the company has a lot to prove on the business side of things and the commercialization of AVs.

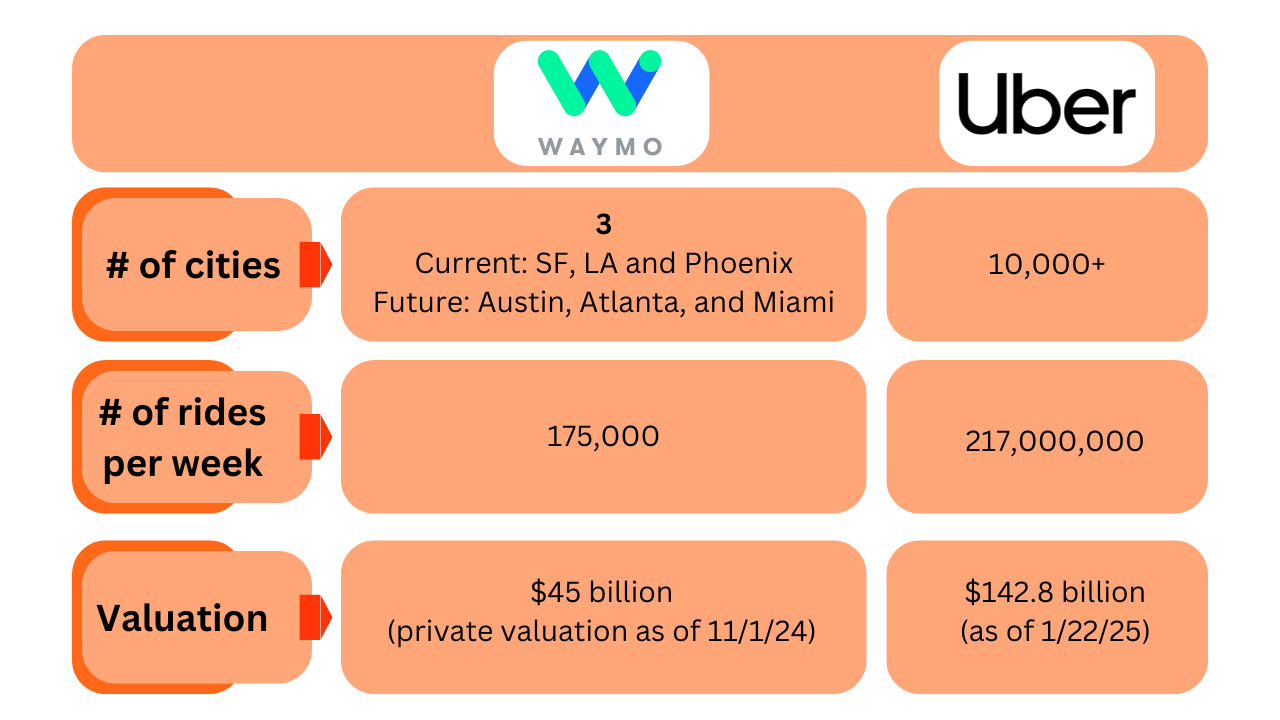

Current Head-to-Head

Let’s start with what we already know and see how Waymo stacks up with Uber.

I always think it’s important to remind folks of the massive global scale that Uber is operating at. The company did 1 million trips concurrently (that means at the same time, don’t worry I had to google it too) last quarter and it barely merited a tweet.

These days, Uber is doing 1,000x the number of weekly trips as Waymo, but valued at only 3.17x (142.8/45). So Waymo’s investors are clearly betting that the company has a LOT of future potential growth.

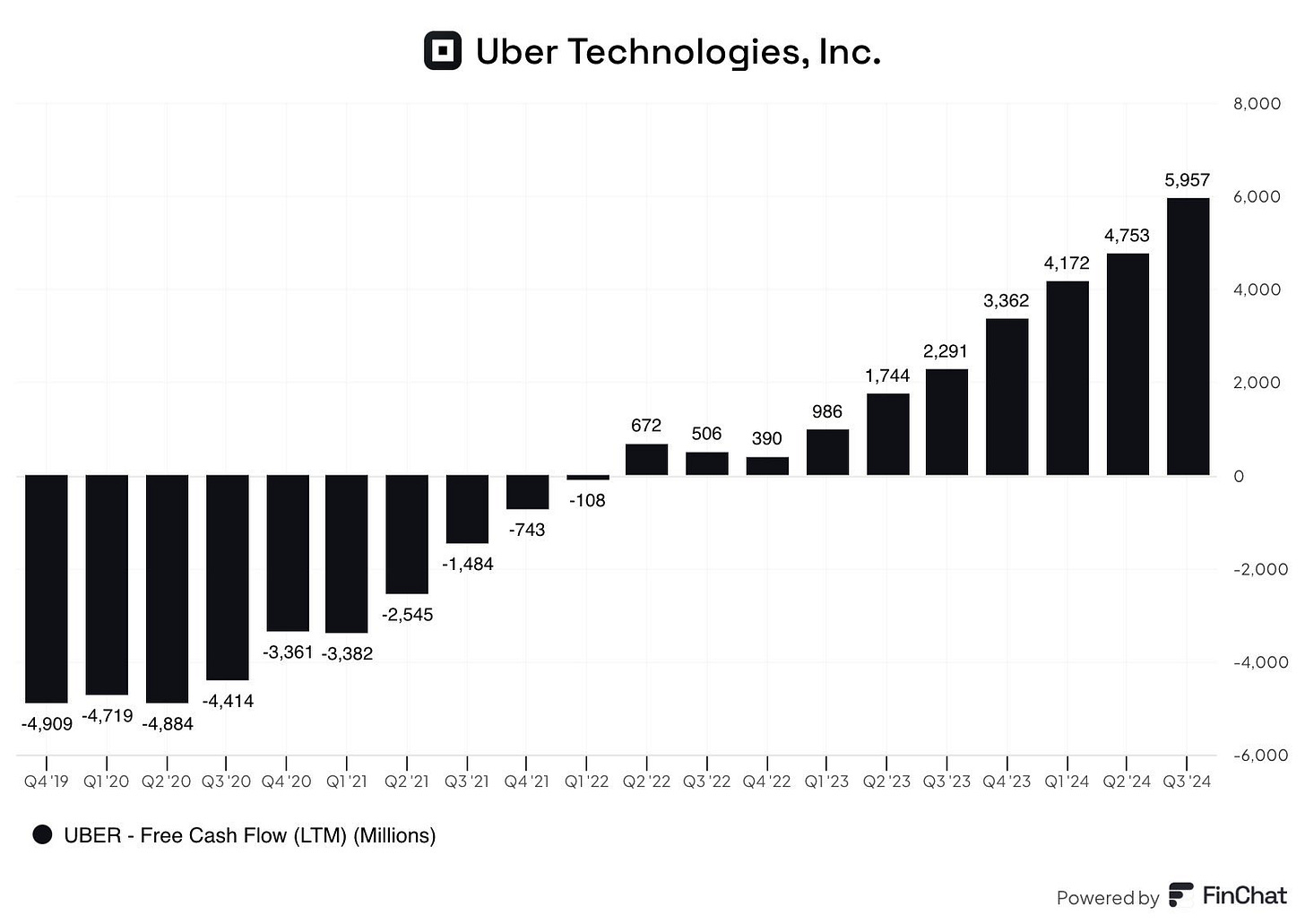

Waymo is still private and investors have poured in $11.1 billion but meanwhile, Uber is printing cash. Driver supply is at an all-time high, demand is strong, and more importantly, customers don’t have a lot of good alternatives. So when you’re stuck at the bar on a Saturday night, you’re willing to pay Uber whatever it takes to get you home. Hence all the free cash flow growth.

Why is there so much hype about Waymo right now?

Put simply: the product rocks. Waymo shows up when it says it will, doesn’t cancel on you and doesn’t talk to you either. It’s a true private ride and even the small creature comforts like being able to adjust the temperature, volume and music selection on your own, multiple times, is convenient.

But while the soft product is great, their hard product is a Jaguar I-PACE with a $75,000 MSRP. Meanwhile, the average UberX vehicle (from our driver surveys on The Rideshare Guy) is an 8-year-old Toyota Prius, with an average price of $30,000. So it’s not really a fair comparison since you’re sitting in a 2.5x more expensive vehicle right off the bat. Obviously Waymo is losing a lot of money on each ride for now, so take advantage while the subsidies last.

It was smart of Waymo to start with a high-end vehicle though since that adds to the overall experience and first impression. As their focus shifts towards reducing costs, they’ll look to more inexpensive vehicles like the Hyundai Ioniq. So you’ll get the same great driver technology but more inexpensive/smaller/less luxurious vehicles.

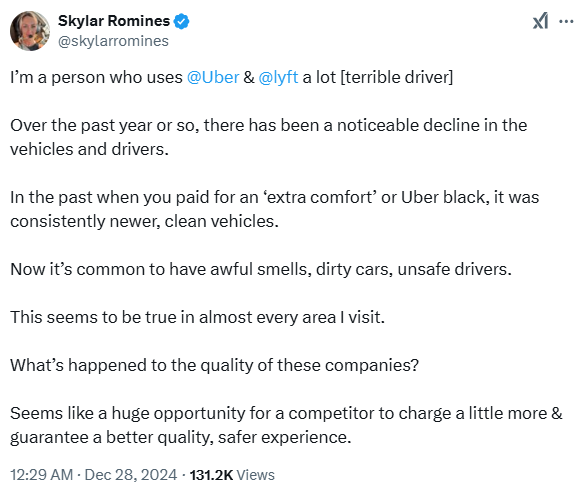

Uber’s Missteps

The other big reason why Waymo’s product stands out is because Uber’s product has been on a slow and steady decline over the past 10 years. All of the things that Waymo excels at are literally the worst parts about taking an Uber.

Because Uber doesn’t own any of the vehicles in its fleet, it’s harder to control the experience. And frankly, I think they have been shortsighted in the way they treat their most loyal, veteran, and best drivers. Uber has always treated drivers like numbers on a spreadsheet and it’s a lot harder to measure the ‘quality of a ride’ than it is the ETA and price. Thus, a lot of their top drivers move on, become jaded, or know that it doesn’t make sense to invest in their business (ie a nice new vehicle). And the service suffers accordingly - when was the last time you had a truly amazing Uber driver?

I expect Waymo to have a big advantage over Uber with large cohorts of riders like female riders and minors (not legal yet but I don’t see any reason why it shouldn’t be) since the benefits of Waymo’s product stand out even more with them. Personally, I would never put my teenage daughter in an UberX and even my wife has told me some alarming stories about occasional issues with her drivers in the past.

Waymo’s Worries

As Waymo scales, they’ll need to take care of the cars and deal with customers who are unfortunately going to treat their vehicles like crap. You would not believe the things that rideshare passengers do in the backseat when there’s a human in the car and things are only going to be worse when there’s no driver.

“No matter what, someone has to take care of the cars,” said Josh Mohrer, a former Uber executive who managed the company’s first push into New York. Mohrer told us he’s skeptical of Waymo’s ability to scale, in no small part because of the messy-car issue. In contrast to a house-sharing platform like Airbnb, the turnover between Waymo users is minutes, not days, which doesn’t leave much room for cleaning, he noted.

And we’re already seeing people outside the cars vandalize the vehicles. Certain governments, states, and countries will also not like the idea of Waymos taking human jobs. I expect the company to see a lot of pushback in places like Europe that have been typically pro-labor (someone’s always on strike).

So while there are no shortage of challenges on the scaling side, I think many of these problems are solvable. If it was easy, someone would have already figured it out. But there’s one area where there product won’t save them.

Why Uber Will Dominate Waymo

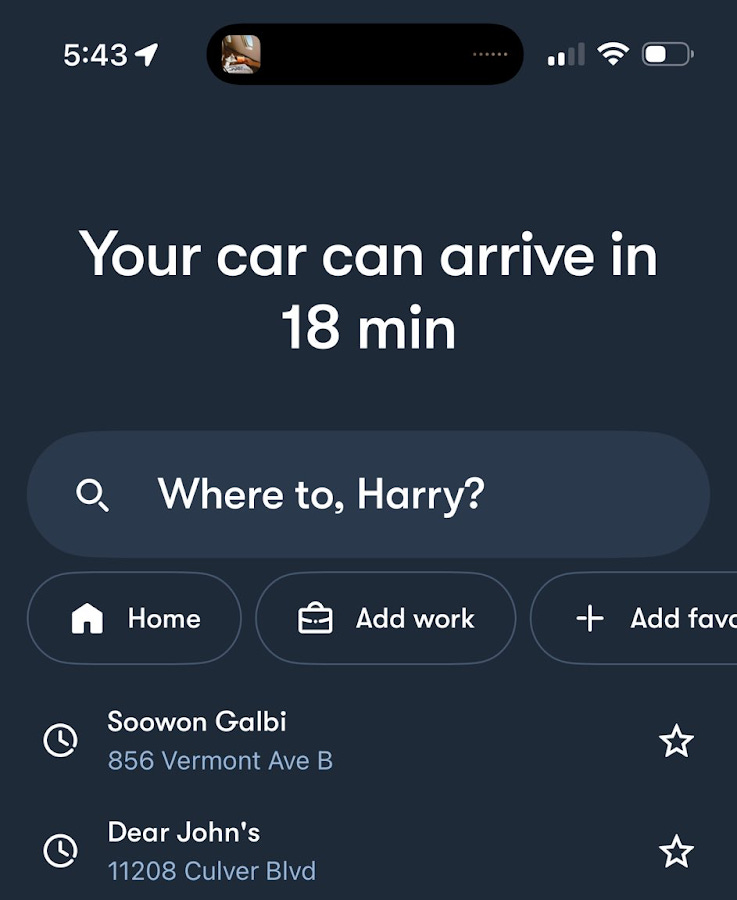

Uber won’t ever be able to match Waymo’s great product experience. But their weakness is also their strength, since the most important KPIs in the rideshare business are reliability and ETA. Waymo has a great product but if you can’t get one in less than 18 minutes, who cares?

With the Uber app, you’ll always have a driver available and an ETA that is often in the 3 to 7 minute range. It may not be at a price that you want, but the reliability and consistency is where they excel.

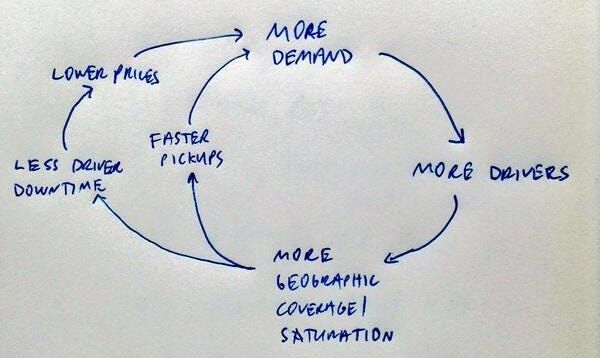

Since Uber has a variable supply of drivers that they can tap into via surge pricing when demand spikes, they have the ability to flex up their fleet to meet peak demand. And the best part is when peak demand is over, those drivers go offline and Uber doesn’t have to worry about or even pay them. Or clean the vehicles, or store them, or charge them.

This allows Uber to not only do higher volume during peak hours, but also charge higher prices, thus increasing their profit margins even further (see chart above). An interesting change they made to their algorithm about 6 years ago was decoupling what the passenger pays and the driver receives (it used to be a flat 75%). Now Uber pays drivers a flat rate surge bonus on surge rides, so they may charge passengers $40 for a ride that’s normally $20 (a 2x surge) and only pay the driver a bonus of $5 on top of their normal $15 for the ride. This allows them to increase their take rate on the most profitable rides.

Waymo on the other hand, has a fixed fleet size since they own and operate all of their cars. So they need to decide:

If they build to peak, they will have way too many expensive vehicles (the vehicles + sensors reportedly cost up to $200,000) sitting idle during times of low demand.

So they’ll likely need to build to average, which means their only tool to mitigate a poor user experience (no availability, or high ETA) is surge pricing. But if they surge too much, customers will notice, complain (imagine the headline: My Waymo charged me $300 to get home!) or even go to competitors like Uber.

For now, it’s clear that demand is greater than supply on Waymo hence the 18 minute ETA I experienced the other night in Los Angeles. But even if Waymo scales up their fleet to meet demand, this will only induce more demand. Thus, creating the same high ETA problem Waymo has today. There isn’t a way for Waymo to solve this with a fixed fleet, which is why a hybrid fleet of AV and human drivers could be so powerful.

Uber 🤝 Waymo

When Waymo launches later this year in Atlanta and Austin, the only way to call for an autonomous ride will be through the Uber app. I think this third party distribution model makes the most sense for Waymo since their roots are those of a tech company. Over the long term, they would much rather operate a high margin software business that pushes their driver technology into every vehicle in the world instead of a low margin one where they own, manage or operate a massive fleet of expensive vehicles.

In the short to medium term, Uber’s human drivers can also handle all of the rides that Waymo can’t/won’t or doesn’t want (too far outside the service area, not mapped yet, inclement weather, etc) so a passenger will always be able to open the app and get a ride (human or robot).

Uber’s network of riders will also be valuable to Waymo since outside of first adopters/tech enthusiasts, I think there’s a lot of apprehension around self-driving cars. I’ve been surprised at how easily Waymo has shot up the app download charts but I don’t know how long that will last as they go to new markets. There’s real apprehension around the technology from everyday people and they may not be as willing to download a new app.

To Recap

Waymo’s biggest advantage over Uber is their great product and consistent experience. But things could get rocky as they go more mainstream - customers may trash the cars, and regulators could slow them down. And let’s not forget that Waymo is a tech company, they don’t want to own and operate expensive vehicles. So why not plug them into the biggest demand generator of them all in Uber? That way, Waymo could get the highest utilization possible for their vehicles and offload a lot of the CapEx and OpEx risk to other parties.

Ultimately, Waymo has a clear path to scale but in a head-to-head battle with Uber, I don’t see them ever being more than a vehicle supplier.

What do you think about Waymo’s prospects - should they do it themselves or partner with Uber? And if they go at it alone, how do they solve the fleet utilization problem?

-Harry

Updates/Corrections:

1/28/25 - Updated ‘the sensors alone reportedly cost up to $200,000’ to ‘the vehicle + sensors reportedly cost up to $200,000’. Thank you

.

Waymo is just too slow, because of cost, regulation, technology and all the operation stuff you have mentioned in the articles. What about the vertical integration business model that Tesla is building? Can it disrupt the whole industry?

Brilliant points. And I think 100% right for the next few years. But my prediction further out, for the Waymo End Game (and my prediction batting average is very poor, you've been warned!) is that Waymo fleets are in the end just DEMONSTRATIONS OF VIABILITY. That in the very long run Waymo doesn't want to run even ONE car, with or without Uber! Sell or rent the hardware and software etc. to a ridehail fleet like Uber (on the app select Human or Robot car...) AND to OEMs.

Imagine "The new BMW 7-Series: the top-of-the-line 7AV is fully autonomous! Why pay a robotaxi by the mile when you can own your own robotaxi? You've taken Waymos and loved them, why not have your own private AV? No need to inhale germs from the prior rider!" Right now of course a personal robotaxi is prohibitively expensive. But when does the price of IT hardware and software NOT come down? Get it to a $20,000 upcharge at purchase and $500 a month and I bet upscale car buyers will line up for it. (I seem to recall many buyers of a certain EV paying quite a lot for a much LOWER level of autonomy.....)