Latest Waymo California Data Dump - Big Jump in Utilization!

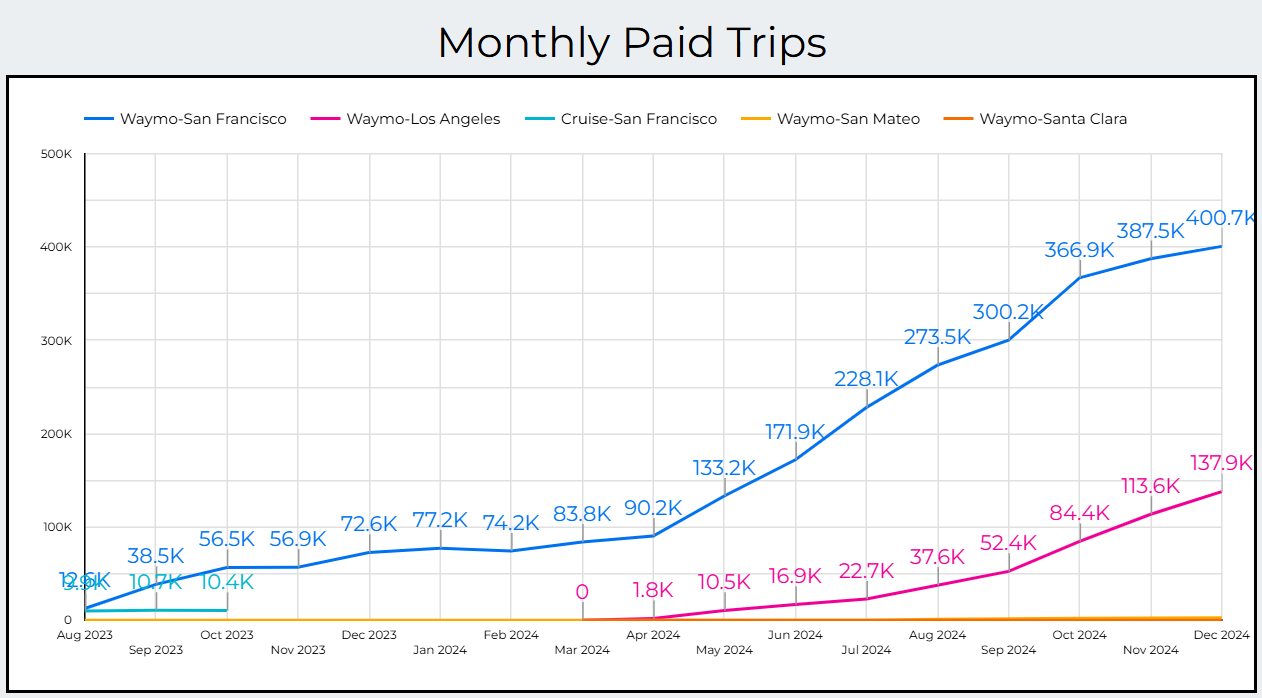

In California, Waymo vehicles are now doing 122,000 weekly rides, the fleet is up to 730 vehicles, and the utilization for each vehicle is up to 24 trips per day (a 33% increase month over month).

Today, I wanted to do a deep dive on a recent data dump (h/t Reddit) from the California Public Utilities Commission (CPUC) since I haven’t seen many people talking about these numbers and they are interesting. The CPUC is also the governing body for Transportation Network Companies like Uber and Lyft. Here’s what they released.

As of 12/31/24, Waymo is doing 122,200 weekly trips in California (San Francisco is 74.4% of that), their CA fleet is up to 730 vehicles (previously their entire fleet was reported as 700 vehicles), and their vehicle utilization is up 33%, from 16 trips per day in November to 24 trips per day in December.

The trip growth is impressive but it does seem like it’s slowing down a bit. This may be due to seasonality since January-March are typically ‘slow months’ for rideshare so it will be interesting to see how Waymo’s trip growth fares in the spring as demand picks up again.

There’s no CPUC data after 12/31/24 but Waymo was doing a reported 175,000 trips per week at that time. So if we extrapolate the actual market share data from December to today (now doing 200k trips per week), here’s what the market share would look like:

Utilization Up 33%!

The big number that stood out to me though was the jump in utilization. A 33% increase in one month is huge — nice work Waymo! Each vehicle is now doing 24 trips per day and for comparison's sake, the average Uber driver can do 2-3 trips per hour during peak hours (conservatively estimated from 8 am - 10 pm) and 1-2 trips per hour during off-peak (10 pm - 8 am).

So a 24/7 human driver in theory (Uber has a 12 hr limit) should be able to do 50 trips per day (14 hours x 2.5 + 10 hours x 1.5). Waymo is at just half that, but I don’t see any reason why they can’t get to 30-40 trips per day in the future.

Trips per day is only one metric that matters though, the other thing we want to know is revenue per trip since not all trips are created equal. Human rideshare drivers know that the easiest way to rack up a bunch of short rides is to go hang near a college campus like USC on a Thursday night and shuttle kids around for 0.5 mile trips. You won’t make a lot of money but if you’re going for a trip based bonus (like Uber Quest) this is a great way to quickly hit the bonus.

Early morning (3-6 am) airport trips on the other hand tend to be longer and much more valuable since there’s no traffic, and are often being expensed by the customer’s company.

What we’d like to know from Waymo would be the utilization by period:

Period 0 - Waymo offline, for charging/cleaning/’no-demand’/etc

Period 1 - Waymo online, waiting for a request

Period 2 - Waymo has accepted a trip, driving to the passenger/waiting for them to come out

Period 3 - Passenger is in the car until the passenger gets out of the car.

In the transportation business, Period 3 is where you make your money - you want your wheels moving fast and a passenger in the car as often as possible in order to maximize profits.

During off-peak hours, Waymo will have a demand problem since there just aren’t that many rides happening. And that’s one of the reasons why they are offering 50% off late night rides. During peak hours, Waymo will have more demand than supply so Period 1 utilization shouldn’t be a major issue unless they build their fleet to peak.

Period 2 is where I think Waymo has the most opportunity since in geographically spread out cities like Los Angeles (Santa Monica to Downtown in the map below is 15 miles), you need a lot of cars to keep ETAs low and utilization up. Check out this map of Waymo’s pick-up areas that was also in the CPUC data dump:

It’s not as concentrated as I would have thought, there are a lot of hot spots all over the city where riders are getting picked up, so Waymo needs to figure out how to position their vehicles, which areas and even which riders to prioritize over others, etc. It’s a complicated task and one of the reasons why markets like LA are tougher than more dense ones like SF.

Here’s the pick-up map for SF, it’s completely different:

You have a few major hot spots (red) that are just 1-2 miles away from each other (SF is 7x7 miles). And most of the rides are concentrated in the downtown areas. This is great for utilization, so it’s not a shock that they’re doing 3x the rides compared to LA. I imagine the utilization is also a lot higher in SF compared to LA.

On my trip to San Francisco this week, there were noticeably more Waymos on the streets compared to just three months ago.

Readers, what stood out to you in this data dump? Do you think Waymo’s trip growth will continue and what do you think about the utilization numbers?

-Harry

Question via e-mail: "Any idea why the pricing still seems somewhat high in LA?"

I'm guessing because their utilization is lower in LA compared to SF. But really, it's up to Waymo to charge whatever they want. They seem to be pricing 10-20% or more than UberX/Lyft on average ime but there's a lot of variability and it all depends on how much Waymo wants to subsidize each trip. I think it makes sense to charge a premium compared to UberX for now though.

The 200+k weekly is ~1 / 22,000 of all US car rides (~4.3B/w). They were at 110k in October, so almost double in four+ months. If the doubling period is 6m., they'll be at 1/1000 rides in mid-2027. Uber and Lyft together are ~210M a week, or 1/20. Uber is shifting share to Waymo in Austin. Factors at play:

1. how quickly can they map new cities

2. how quickly can they add vehicles (and the capital to purchase them)

3. are any cities (perhaps because of state regulators) less suitable to Waymo than to U/L (NYC?)

4. what sub-contracting deal do they negotiate with Uber

5. are any cities more suitable to Waymo than to U/L

6. is Waymo's capital cost low enough to compensate for the loss of drivers' unwittingly subsidizing Uber by depreciating their personal cars (and in other ways)

7. ... ?